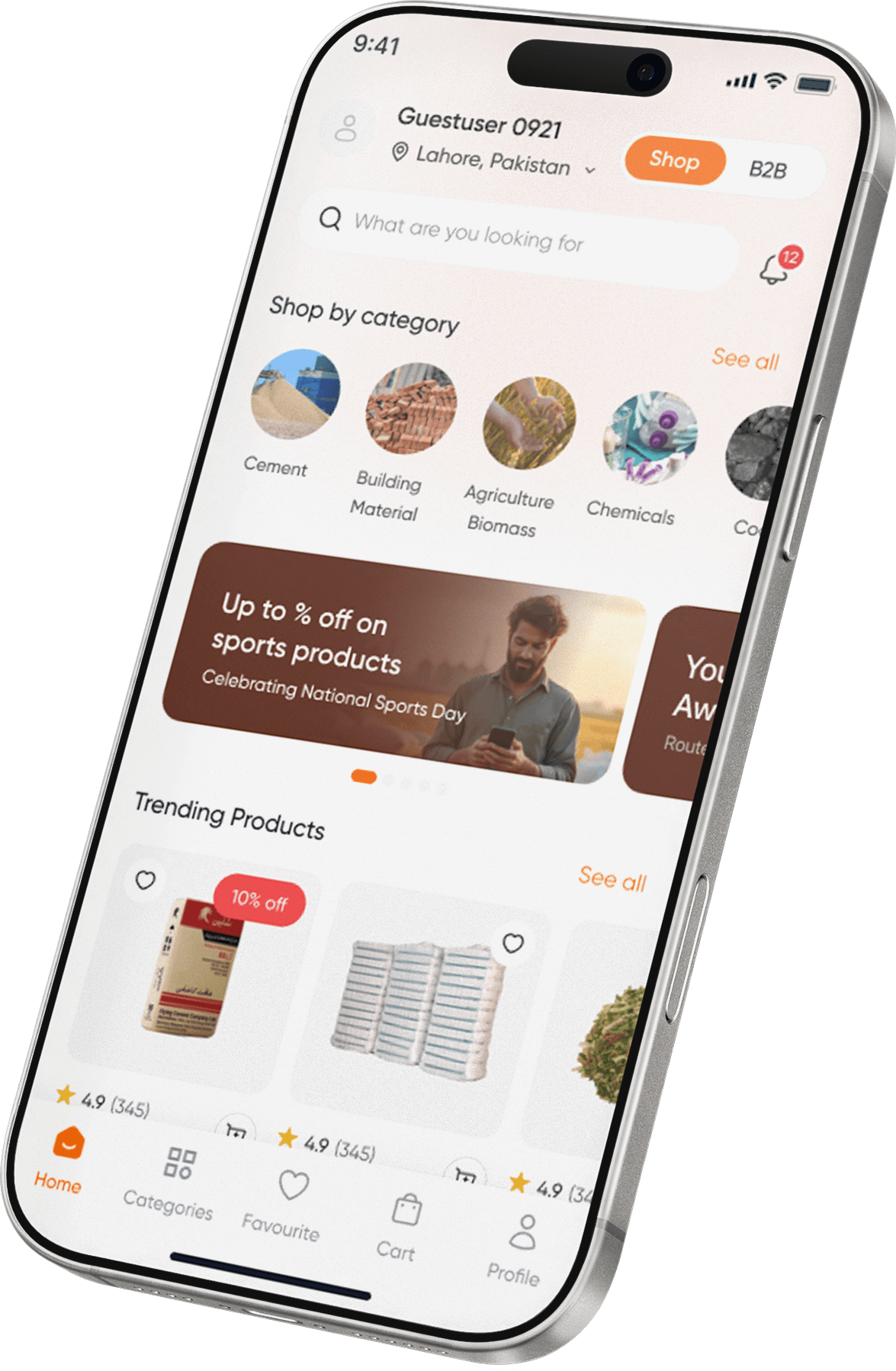

Apply For Credit

How to apply

Steps to Follow For Successful Application

Check Your Eligibility

Make sure your business meets our credit criteria for biomass procurement.

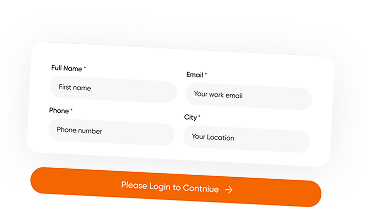

Submit Application

Fill out the online form with accurate details and upload the required documents.

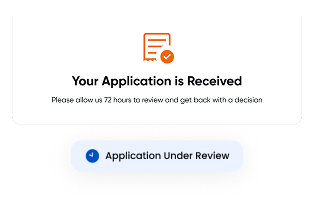

Application Review

Our team will assess your application and notify you of the outcome within 72 hours.

Credit Disbursement

Once approved, the credit amount will be disbursed directly to your supplier or account.

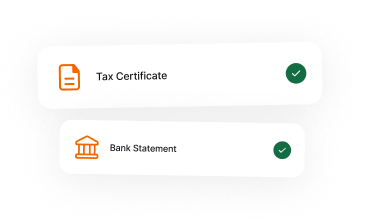

Documents

Required Documents

A quick checklist to speed up your credit approval — keep these ready for a seamless application process.

Tax Registration Certificate

This helps us confirm your business is operating within regulatory frameworks.

Company Incorporation Certificate

We use this to verify your legal entity status before processing your credit request.

1-Year Bank Statement

We assess cash flow and creditworthiness based on your recent banking activity.

Copy of Post-Dated Cheque

Used as part of the agreement to secure your repayment cycle.

Credit Request on Letterhead

This formalizes your intent and outlines the requested credit amount and purpose.

Fast-Track Your Access to Business Credit

Share your information to explore customized credit solutions.

Get the working capital your agribusiness needs — fast, reliable, and tailored for Pakistan's commodity supply chain.

Only available for agricultural biomass commodities.

Why Choose Zarea Credit

Apply for Credit Benefits

From improved cash flow to stronger supplier relationships, our credit facility is more than a loan — it's a strategic tool designed for modern agribusinesses.

Smarter Procurement

Source agri-commodities at competitive prices.

Improved Cash Flow

Free up your capital and keep your operations running smoothly.

Apply Anytime, Anywhere

Fully digital credit process — no paperwork, no hassle.

No Collateral Needed

Secure Trade Services without pledging assets.

Fast Turnaround

Credit decisions within 72 hours — speed matters.

Boost Your Margins

Reduce upfront costs and unlock higher profitability.

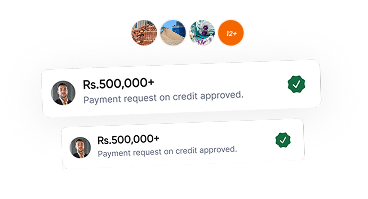

Instant Disbursement

Funds released quickly after supplier invoice submission.

Flexible Credit Cycle

Revolving credit designed for your working capital rhythm.

Frequently Asked Questions

Clear answers to help your business trade smarter, faster, and with full confidence on Zarea.

Stay Informed with Zarea

Get real-time updates, news, and stories shaping the future of trade and commerce with Zarea.